Redundant assets (liabilities): what are they?

Many business owners leverage their corporate veil to invest excess cash flow into profitable asset classes. Companies use such mechanism to

1. Diversify risk by owning assets that generate higher rates of return than the business;

2. Generate additional cash flow, used as financial backup in case of financial distress;

3. Reduce operational costs by creating operational synergies;

4. Benefit from lower tax rates through the corporation;

5. Benefit from easier financing terms and conditions through the corporation; and/or

6. Protect their assets through the corporate shield.

Accordingly, this creates corporate ownership of tangible asset classes that are not essential to the operations of the business. In valuation terms, these assets are qualified as “redundant”.

Although, this qualifier is not necessarily appropriate. So called “redundant assets” are not duplications, rather “extra” assets that the business owns.

What you need to know about redundant assets.

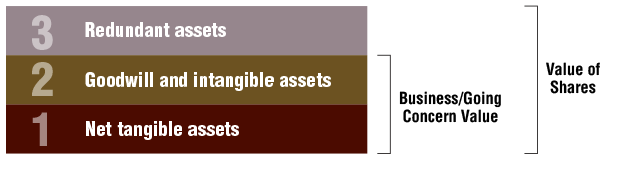

The value of a business can be separated as follows:

Redundant assets are not necessary to the ongoing operations of the business. Therefore, a potential purchaser is unlikely to be interested in them.

Accordingly, it is assumed that the vendor of a business would remove these assets from the business entity.

If they were not removed, the vendor would require compensation for them.

Income taxes on redundant assets

In our previous article, we explained the differences between asset purchase vs share purchase. It was explained that, when assets are being purchased, the corporation will generate different types of income taxes (losses).

1. Taxable capital gains (losses)

2. Taxable business income (loss)

3. Taxable depreciation recapture (terminal loss)

Financial statement analysis

When analyzing the Profits & Losses of a business, it is important to account for redundant income and expenses. Indeed, these will skew the comparative results if they are not separated from operational results.

EBITDA therefore needs to be adjusted for these elements. Periods can then be compared with much more accuracy.

Business valuation

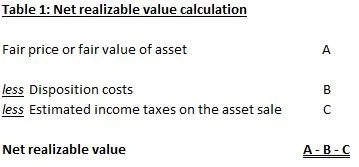

Individual non operating assets usually offer a different return on investment than the business itself. Therefore, they need to be separated and valued independently. The method used is the net realizable value.

The value of a redundant asset is equal to the

Active vs. passive use of the asset

To determine whether an asset contributes actively to the operations of a business or not, many criteria need to be analyzed. This is an issue that tax specialists also encounter.

Real estate

Usually, real estate will have a more passive nature. This form of investment that generates rental income is usually not necessary to the business.

However, if a real estate is held for resale, it could be considered as inventory in an active business. This will disqualify it as being redundant in nature.

Life insurance policies

Many business owners will include a life insurance policy that are not necessary to their business operations. Normally, these are treated separately to the core activities.

However, this isn't the case if the loan issuer asks to have a life insurance policy on the loan value.

Other examples of redundant assets and liabilities

Excess cash or working capital

Cash is considered non operational when it could be invested elsewhere without impacting day-to-day operations. When analyzing whether the company has excess cash flow, the working capital needs to be analyzed.

If non-cash working capital is comparable to the industry average and historical levels, it can then be considered as redundant.

Marketable securities

Once a business has determined that it can use its excess cash flow elsewhere, the obvious choice is to invest them.

It is more logical to invest cash flow in high risk securities that offer a higher return than the business itself.

Investment in a related or non-related entity

Many corporations own other entities, for tax planning purposes or to separate operations. The value of these separate entities needs to be valued at their net realizable value and treated as redundant.

Personal automobiles and other capital assets

Personal expenses should be treated separately from core business activities.

Bank Loans and other liabilities for personal use

These debts need to be excluded from the business core activities, as they are used to purchase assets for personal enjoyment.

Conclusion

Redundant assets occupy a critical role in business. Business owners usually invest their additional cash flow is other class of assets that can generate high returns on investment.

These can cause issues when trying to buy or sell a business.

Tax consequences need to be considered such as the

capital gain on disposal;

depreciation recapture;

business income generated.

A business valuator can help you understand

The performance of your business

Any tax liabilities your business has on its non-core assets.

Learn the mistakes to avoid when creating your business plan. This article offers tips for developing an effective business plan for your company or venture.