Business blog

How to value a business

Business valuation is one of the few disciplines in finance that combines both art and science. Indeed, a business’s value is determined by the application of various methodologies and a bit of judgment. This is why one business valuation method will differ from another.

Redundant assets (liabilities): what are they?

Many business owners use their corporation to buy personal assets. These assets are not needed for business purposes. In this article, you will learn how holding “redundant asset” can have an impact when buying or selling a business, valuing a business or during tax planning.

Asset purchase vs share purchase

When an investor ("Acquirer") is purchasing a business, the tax implications of the transaction have to be considered. It is important for the acquirer to make the proper income and sales tax due diligence of the target before proceding. The seller will look to maximize the net value of the transaction.

Financial statement forecasting.

Financial forecasting is the process of building financial projections using reasonable and accurate assumptions about your business. Also known as financial modeling, the process of forecasting your cash flow, income statement and balance sheet require in-depth understand of the financial components of a business.

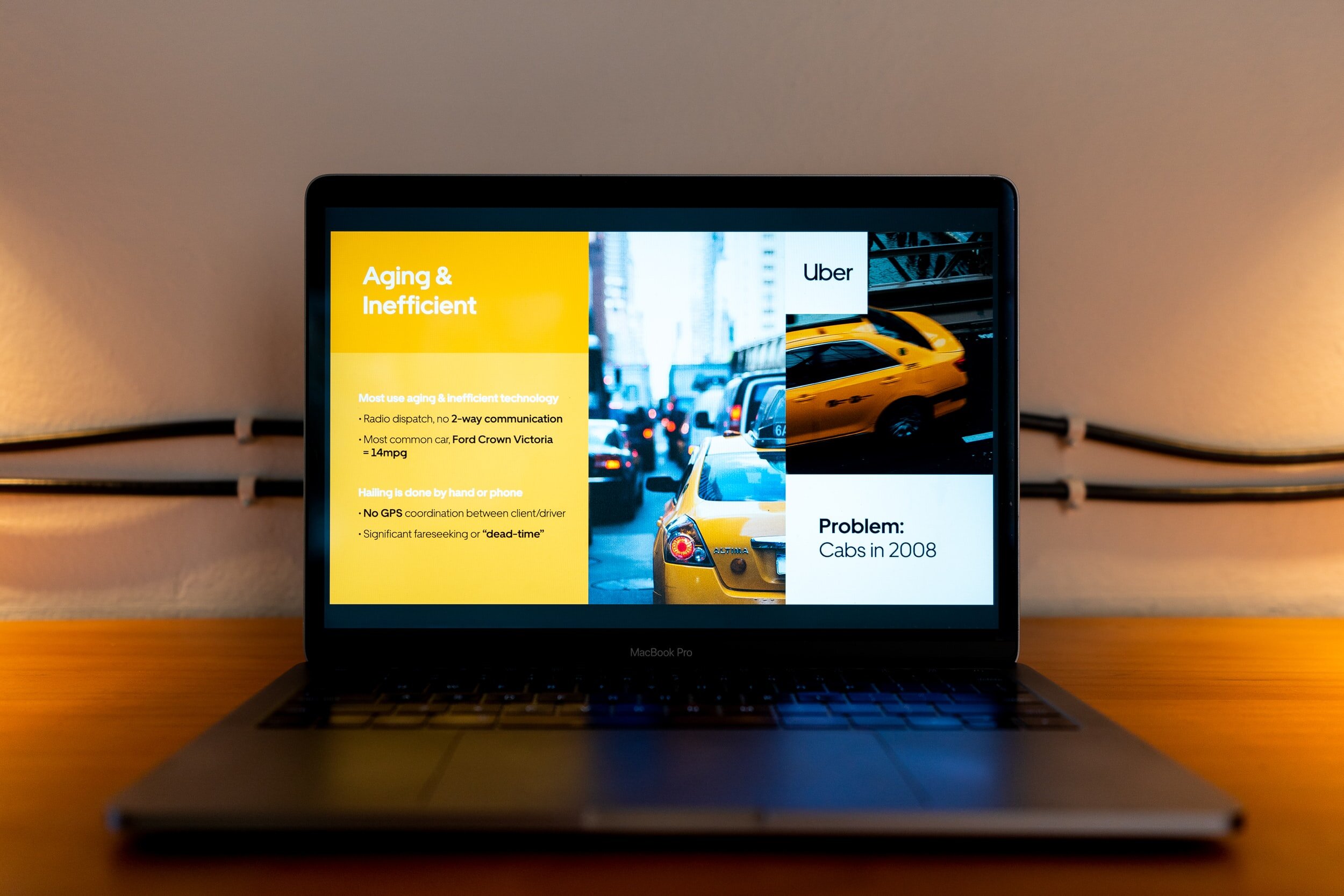

The pitch deck creation process.

A pitch deck is a brief presentation to investors using a professional document that clearly presents your business in a concise manner. It is usually delivered through a live presentation to investors. The pitch deck should not be more than 23 pages long.

Business plan Canada: raise financing or attract investors

A business plan is a standard document requested by many authorities that clearly outlines the roadmap to your business success. Writing a good business plan will align your business ideas with market realities, providing clarity to many aspects of business operations. By leveraging this strategic process, you will be able to set measurable objectives and benchmark your progress over time.

Which independent valuation report choose?

An independent valuation report is required in many situations. Before proceeding, it is wise to call upon the services of a Chartered Business Valuator (“CBV”). Many different valuation reports exist, along with their respective fee structure. In this article, we present an overview the comprehensive valuation report, the estimate valuation report and the calculation valuation report.

Why and how to draft a Confidential Information Memorandum?

Finance is not all about numbers. In some cases, soft skills such as writing, pitching, negotiating and selling are more valuable assets.

In the case of mergers and acquisitions (“M&A”). Selling a business involves following a thorough process and drafting formal documents such as the confidential information memorandum (“CIM”). This document is also used in investment banking, private equity and other sell-side roles.